2025 Annual Gift Limit. The lifetime gift tax exemption allows you to make large gifts without incurring gift taxes. Learn how to help your clients make the most of it now.

For individuals that are not in danger of having taxable estates, there’s. The federal lifetime estate and gift tax exemption will sunset after 2025.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, But because the tcja sunsets on december 31, 2025, the estate. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

2025 Maximum Annual Limits on CostSharing Benecon, With the increased exemption amount through 2025, certain lifetime gifting strategies can be implemented now, before the sunset, to reduce estate values and estate tax liability. Spouses can elect to “split” gifts, which doubles the annual amount a married couple can give away in any year.

Understanding The Annual And Lifetime Gift Tax Exclusion Limits How, There's no limit on the number of individual gifts that can be made, and couples can give. For individuals that are not in danger of having taxable estates, there’s.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, For individuals that are not in danger of having taxable estates, there’s. After 2025, the lifetime gift tax exclusion.

Preparing for the Estate and Gift Lifetime Tax Exemption Sunset (2025), The system was due to begin operating by the end of this year, but that has been extended until the end of 2025. The lifetime gift tax exemption allows you to make large gifts without incurring gift taxes.

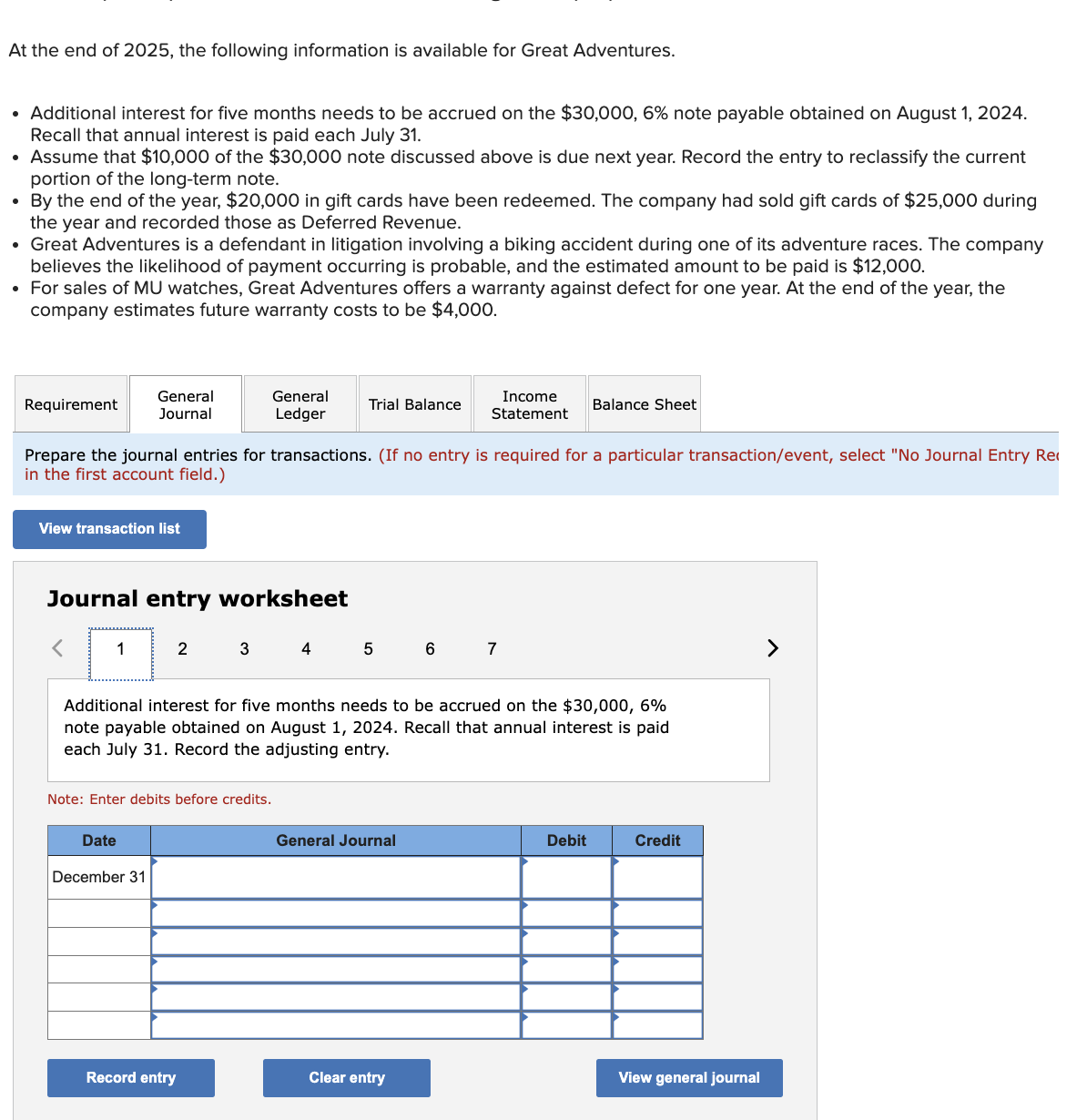

Solved At the end of 2025, the following information is, Once you gift over the annual gifting limit, you begin to eat into your lifetime gift and estate tax exemption. There's no limit on the number of individual gifts that can be made, and couples can give.

RPLG explains changes in annual gift limit for Form 700 filers PublicCEO, It would require all poker machine players to. There's no limit on the number of individual gifts that can be made, and couples can give.

Podcast IRS limits relief for large gifts prior to estate tax, The federal lifetime estate and gift tax exemption will sunset after 2025. The heloc limit was applied on top of the $1 million regular loan limit, for a total of $1.1 million.

2025 IRS Gift Limits Navigate the Annual Gift Exemption, With the increased exemption amount through 2025, certain lifetime gifting strategies can be implemented now, before the sunset, to reduce estate values and estate tax liability. Clients can make “annual exclusion” gifts of $17,000 (2025, indexed) per recipient, which removes that amount, plus any growth on that amount, from the client’s.

CMS releases costsharing limits for 2025 plan years Christensen Group, The annual gift tax limit and the lifetime gift tax limit. How does it do this?